Important supermarkets and grocery stores statistics

- There are 63,348 supermarkets and grocery stores in the United States

- 21.5 percent of grocery sales accounted for will be online sales by 2025

- Saturdays are the worst time to go grocery shopping

Supermarket Chains in the United States have evolved in the previous decade. Some of the newly introduced features such as online grocery delivery and pick-up have become the new normal. However, some of its growth projections were met earlier than forecasted due to the COVID-19 pandemic.

It comes as no surprise that most people are taking advantage of online features. But still, many people are still doing their grocery shopping in person.

How many supermarkets are there in the United States?

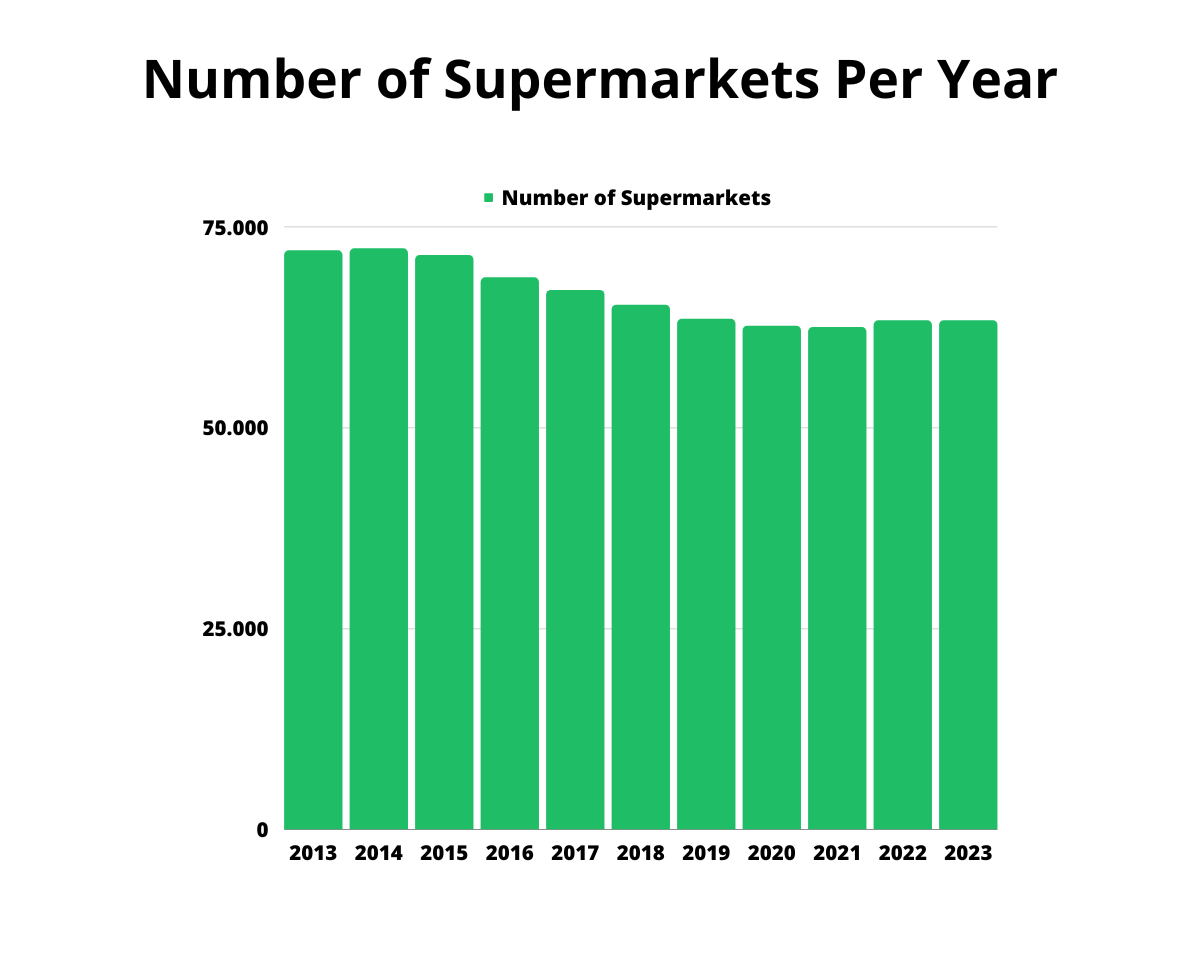

As of 2023, there are 63,348 supermarkets and grocery stores in the United States. While the number of stores witnessed a decline, the numbers remained steady from 2020 onward.

Number of supermarkets per year

| Year | Supermarkets |

| 2013 | 72.050 |

| 2014 | 72.304 |

| 2015 | 71.467 |

| 2016 | 68.689 |

| 2017 | 67.116 |

| 2018 | 65.287 |

| 2019 | 63.526 |

| 2020 | 62.672 |

| 2021 | 62.489 |

| 2022 | 63.328 |

| 2023 | 63.348 |

Number of supermarkets per state

The three US states with the most supermarkets are:

- New York (13,077)

- California (10,595)

- Florida (5,234)

| State | # of Stores |

| Alabama | 1.045 |

| Alaska | 288 |

| Arizona | 1.054 |

| Arkansas | 692 |

| California | 10.595 |

| Colorado | 1.065 |

| Connecticut | 1.106 |

| Delaware | 245 |

| Florida | 5.234 |

| Georgia | 2.283 |

| Hawaii | 390 |

| Idaho | 362 |

| Illinois | 3.527 |

| Indiana | 1.251 |

| Iowa | 835 |

| Kansas | 686 |

| Kentucky | 998 |

| Louisiana | 1.208 |

| Maine | 501 |

| Maryland | 1.684 |

| Massachusetts | 1.885 |

| Michigan | 2.400 |

| Minnesota | 1.396 |

| Mississippi | 555 |

| Missouri | 1.403 |

| Montana | 354 |

| Nebraska | 578 |

| Nevada | 447 |

| New Hampshire | 340 |

| New Jersey | 3.354 |

| New Mexico | 340 |

| New York | 13.077 |

| North Carolina | 2.725 |

| North Dakota | 241 |

| Ohio | 2.846 |

| Oklahoma | 854 |

| Oregon | 1.023 |

| Pennsylvania | 3.630 |

| Rhode Island | 292 |

| South Carolina | 1.238 |

| South Dakota | 273 |

| Tennessee | 1.270 |

| Texas | 4.993 |

| Utah | 550 |

| Vermont | 310 |

| Virginia | 2.110 |

| Washington | 2.158 |

| West Virginia | 400 |

| Wisconsin | 1.346 |

| Wyoming | 131 |

| District of Columbia | 70 |

Source: IBISWorld

How many supermarket chains are there in the United States?

In the United States alone, there are five nationwide supermarket chains:

Ahold Delhazie (21 different chains including Food Lion, Hannaford, Stop & Shop, and Giant ; over 2000 stores in 23 US States)

Kroger (which includes Safeway, Albertsons, and their own stores in all 50 states and DC)

Target (Super Target ; 239 stores in 12 states)

Costco (583 stores in 46 states excluding Maine, Rhode Island, West Virginia, and Wyoming)

Walmart (Including Walmart Neighborhood Market and Sam’s Club ; 50 states and District of Columbia)

There are fourteen regional supermarket chains in the United States including:

West

Raley’s (Alaska, Arizona, California, Nevada, New Mexico, Oregon, and Washington)

Save Mart (California and Nevada)

Smart & Final (Arizona, California, and Nevada)

WinCo Foods (Arizona, California, Idaho, Montana, Nevada, Oklahoma, Oregon, Texas, Utah, and Washington)

South

Food City (Alabama, Georgia, Kentucky, Tennessee, Virginia)

Ingles Markets (Alabama, Georgia, North Carolina, South Carolina, Tennessee, Virginia)

Piggly Wiggly (Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, and Virginia ; also includes out-of-region states such as Illinois, Indiana, Ohio, Minnesota, Missouri, North Dakota, and Wisconsin)

Publix (Alabama, Florida, Georgia, Kentucky, North Carolina, South Carolina, and Tennessee)

Midwest

Hy-Vee (Iowa, Illinois, Kansas, Minnesota, Missouri, Nebraska, South Dakota, and Wisconsin. Also includes out of region states like Alaska, Hawaii, Maine, New Hampshire, Pennsylvania, and Rhode Island)

Meijer (Illinois, Indiana, Michigan, Wisconsin. Also includes out of region states of Alaska, Hawaii, Maine, Missouri, Pennsylvania, and Rhode Island)

Schnucks (Illinois, Indiana, Iowa, Wisconsin. Includes out of region states such as Alaska, Hawaii, Maine, New Hampshire, Rhode Island, and Pennsylvania)

Northeast

ShopRite (Connecticut, Delaware, Maryland, New Jersey, New York, Pennsylvania)

Weis Markets (Delaware, Maryland, New Jersey, Pennsylvania, New, York, West Virginia, Virginia)

Wegmans (Pennsylvania, New York, New Jersey, Massachusetts, Maryland, North Carolina, Virginia, Washington, D.C., Delaware)

It should be noted that there are several different local grocery chains. Many of them either operate in one state or metro area. Others may have franchises in multiple states, but are not considered a larger regional chain.

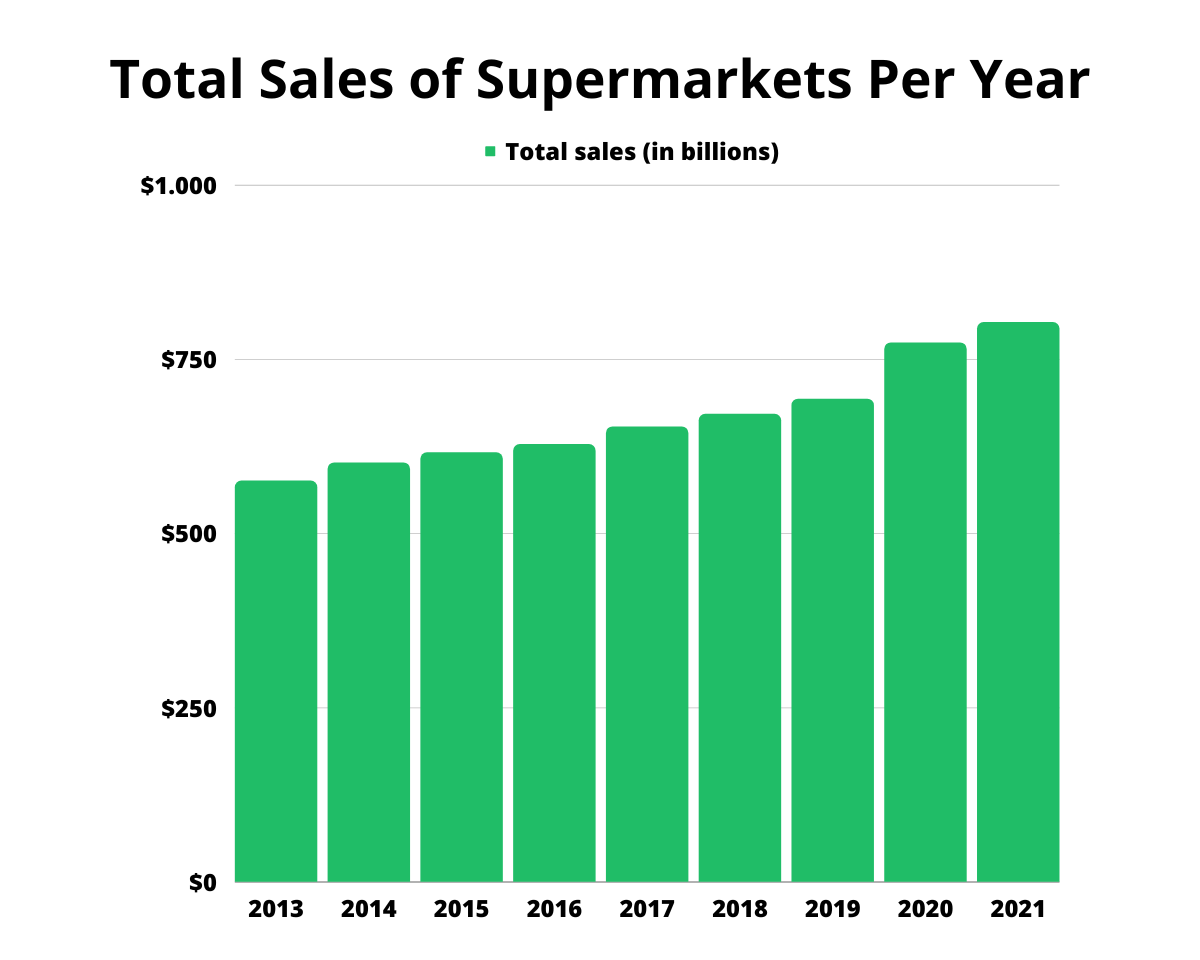

Total sales of supermarkets per year

| Year | Total sales (in billions) |

| 2013 | $575.48 |

| 2014 | $601.5 |

| 2015 | $616.09 |

| 2016 | $627.87 |

| 2017 | $653.18 |

| 2018 | $671.33 |

| 2019 | $693.02 |

| 2020 | $773.74 |

| 2021 | $803.05 |

Source: Statista

Urban vs rural: Where are these supermarkets/grocery stores located?

The location of these grocery stores plays a role in the services that are available. For example, grocery stores that have online pickup or delivery will mostly be available in urban locations. These may not be available in rural areas.

There are 1947 non-metro counties in the United States (with 23 of them without any types of food retailers). There are 44 counties in the United States without a grocery store with 90 percent of those counties being rural and the remaining 10 percent in urban counties). This means that residents in those areas will need to commute to neighboring counties or larger communities (depending on the location) to go grocery shopping.

As a substitute for grocery stores, many rural areas have relied on budget stores such as Dollar General, Family Dollar, and similar dollar-store chains. In the United States, these dollar stores and supercenters have grown considerably over other store types between 1990 and 2015.

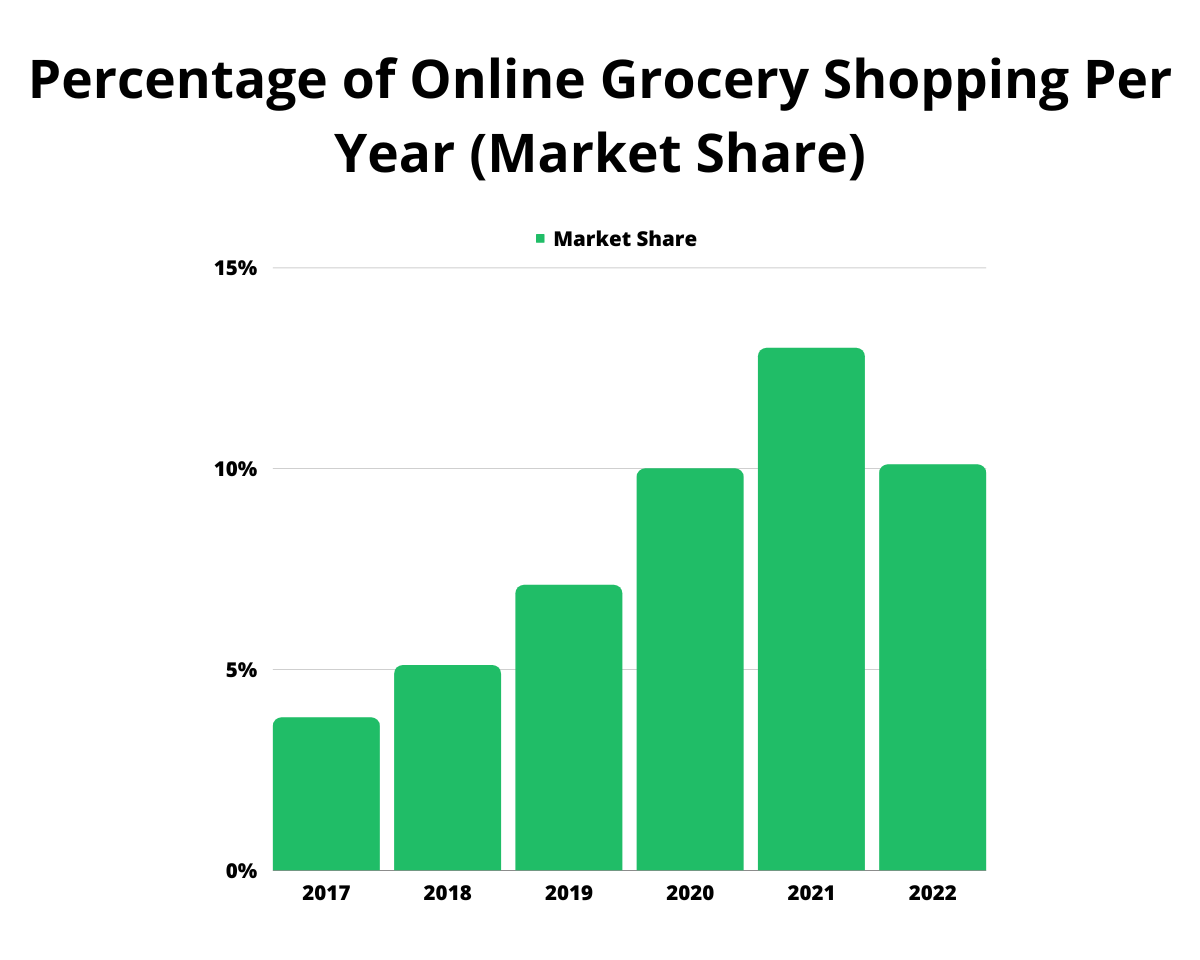

Physical vs online grocery shopping?

Percentage of Online Grocery Shopping Per Year (Market Share)

| Year | Market Share |

| 2017 | 3.8% |

| 2018 | 5.1% |

| 2019 | 7.1% |

| 2020 | 10% |

| 2021 | 13% |

| 2022 | 10.1% |

Sources: Invesp, Supermarket News, Supermarket News

Physical grocery stores are available in all 50 states. Online grocery pickup is available as well across the country in participating locations. However, online ordering and delivery will depend on the location.

As mentioned before, more urbanized areas will have online delivery while rural areas may not. Again, location, logistics, and resources play a role. Notably, Trader Joe’s does not deliver groceries. Some supermarket chains do their own grocery delivery while other supermarket brands contract third-party services such as InstaCart or DoorDash.

Walmart had previously contracted with DoorDash to handle grocery deliveries (where available). As of September 2022, this is no longer the case. However, Albertsons, Safeway, Meijer, and Hy-Vee offer delivery services through DoorDash.

Other third-party delivery services that handle groceries include Shipt, FreshDirect, and Boxed (among others).

In terms of statistics, online grocery sales are surging. It is expected that by 2025, it will account for 21.5 percent of the total sales (or approximately $250 billion). Meanwhile, 78 percent of shoppers prefer visiting the store itself even after the COVID-19 pandemic.

Many shoppers that preferred the online grocery approach gave their reasons. 62 percent state concerns with COVID-19 and also convenience. 42 percent say that it’s a time saver.

Older shoppers (age 45 and older) shifted to online shopping. However, 43 percent of shoppers believe that when it comes to getting better quality products, they would rather do it in-store rather than play the guessing game and order online.

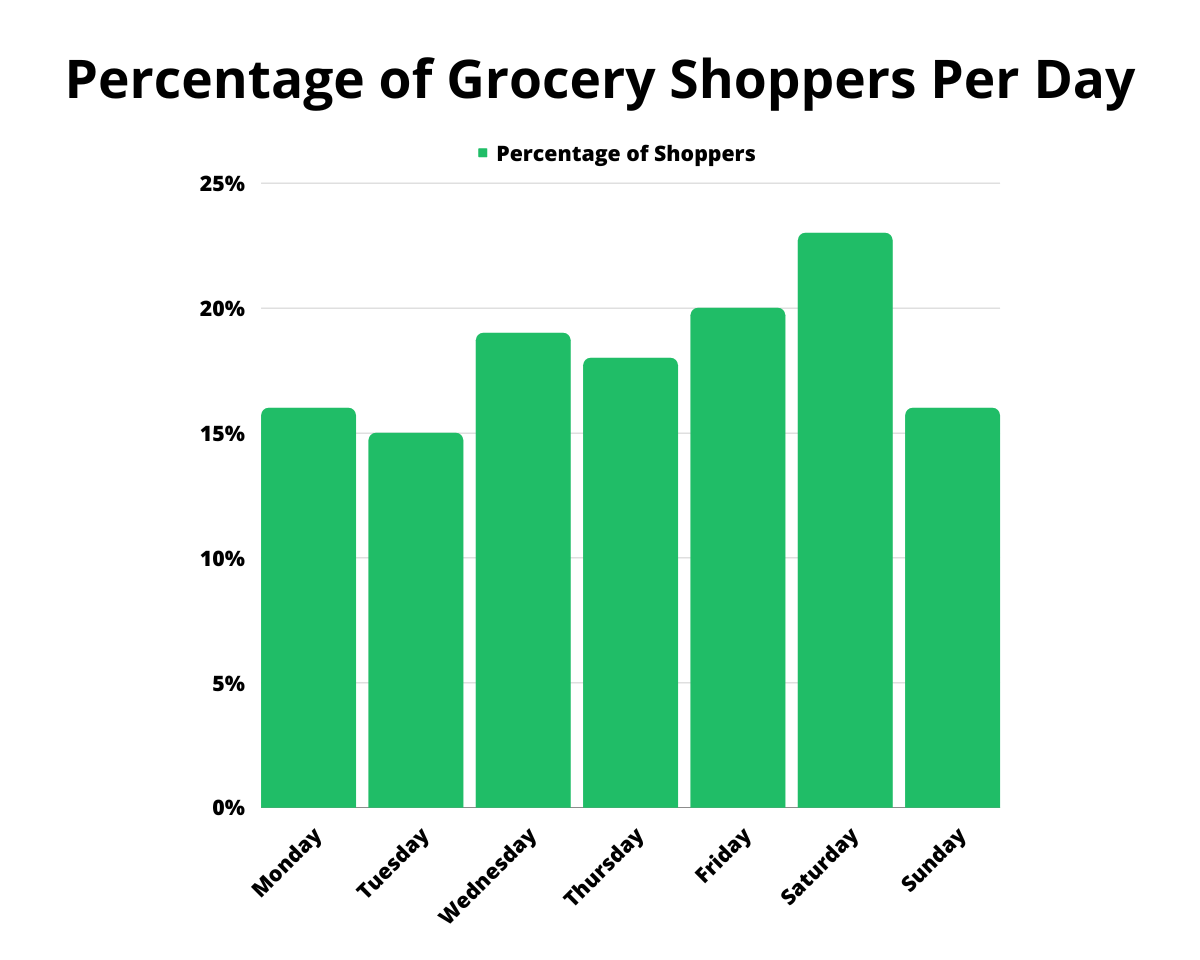

Busiest days of the week for grocery shopping

| Day | Percentage of Shoppers |

| Monday | 16% |

| Tuesday | 15% |

| Wednesday | 19% |

| Thursday | 18% |

| Friday | 20% |

| Saturday | 23% |

| Sunday | 16% |

| No specific day | 36% |

Source: Drive Research

Of all the days of the week, the weekends are usually the busiest. This can apply to both physical and online grocery orders. In the case of the latter, the sooner you can book a time that is best for you, the better. Delivery options may serve as the best alternative (if available in your area).

Aside from the weekend, weekday afternoons and early evenings may see some steady activity in terms of grocery shopping. This can be due to the fact that they may be grabbing something to cook at home for dinner (for themselves or their household).

Therefore, weekday mornings and midday hours are typically the least busy times of the week. Wednesdays and Thursdays are often the best times for budget shoppers since there may be specials on those days. Saturdays are considered the worst day to go grocery shopping.

What products are most popular in grocery stores?

A list of most popular products in grocery stores

- Perishable foods (meats, fish, produce, dairy, frozen foods, etc.): 51.47 percent

- Health and beauty: 4.70 percent

- General merchandise: 1.28 percent

Source: Balance everything

With supply chain disruptions and increased prices, there are various products that are popular amongst grocery shoppers. For example, American shoppers will spend a combined $12 billion on carbonated beverages. Meanwhile, they are also spending a total of $6 billion on cereals.

Frozen foods usually net around $6.13 billion annually. Milk, a popular staple product, has Americans spending close to $12 billion alone in a year. Americans are spending a total of $5 billion on laundry detergent.

Finally, produce accounts for nearly $5.2 billion in spending by shoppers.

Average prices of products

The following average prices are based on nationwide figures. The prices may vary from state to state. Here are the average prices of the following products:

Milk: $4.44 (1 gallon of whole milk)

Eggs: $3.59 (One carton ; as of November 2022)

Chicken and beef: $3.99-$11.97/pound (beef, depending on store), $3.99-$4.79/pound (chicken)

Fruits and veggies: Dependent on farm price and location.

Most Profitable Supermarket Chains in the United States

The list of supermarket chains below include parent companies of other supermarket chains (i.e: Ahold Helhaize USA). Let’s take a look at the following below:

| Chain | Total sales Q3 (in billions) |

| Costco | 54.4 |

| Walmart | 48 |

| Kroger | 34.2 |

| Aldi | 30.3 |

| Ahold Delhaze USA | 22.6 |

| Albertsons | 18.2 |

| Trader Joe’s | 3.3 |

Kroger

The total sales for Q3 2022 were $34.2 billion. Compared to the same quarter from the previous year, the company gained $2 billion. Digital sales had increased 10 percent between Q2 2022 and Q3 2022.

Delivery sales from the previous year increased by 34 percent. This was due to Kroger Boost, a customer membership program that provides them free grocery delivery. Customer fulfillment centers also played a role in the company’s bump in revenue.

Walmart

The Walmart Corporation (Wal-Mart and Sam’s Club) collectively raked in $467 billion in net sales. In Walmart stores alone, 55.7 percent of those sales accounted for grocery (approximately over $200 billion). Meanwhile, 64 percent of Sam’s Club’s net sales were grocery and consumables (approximately $48 billion).

If we’re going to crunch numbers, about 60 percent of the collective net sales are linked to grocery for the Walmart Corporation. Effectively, this makes them one of the highest revenue getters in terms of grocery chains in the United States (despite being a retail chain that sells more than just groceries).

Albertsons

Albertsons estimated revenue for its most recent quarter in 2022 was $18.20 billion. In Q3 2022, they also saw digital sales increase by a third compared to the previous year. At this time, there is talk of a merger between the company and Kroger’s.

As of October 13, 2022, the two companies have created a ‘Merger Agreement’. Kroger is scheduled to acquire all outstanding shares of the company’s stock. In the history of the grocery industry, this is set to be the largest merger deal.

If successful, Kroger will have more than 5000 stores and 2000 centers under its name. On top of that, it will also become one of the largest pharmacy operators in the country.

Ahold Delhaze USA

The Netherlands-based Ahold Delhaze has a USA operated company that oversees 21 different grocery chains. These include but are not limited to Hannaford, Giant, Stop & Shop, and Food Lion among others.

In the previous quarter, Ahold Helhaze USA posted a quarterly revenue of $22.568 billion. This is a slight decrease from the previous quarter. Nevertheless, their annual revenue has since increased from 2018.

In terms of digital sales, they saw a near 21 percent increase. Money wise, they crossed the billion dollar threshold, posting a total of $1.08 billion. This is due to the company adding 1471 pickup sites for online grocery.

That number is projected to be close to 1550 by the middle of 2023. Food Lion was the top chain of the Ahold Delhaze USA family, which plans to expand its ‘Food Lion To Go’ service to more than 1000 stores in the coming year (currently, it’s available in 601 stores).

Hannaford was also a strong performer under the Ahold name. Stop & Shop has recently remodeled 31 of their stores as part of their five-year upgrade program. Those stores have surpassed the sales and profit expectations, according to Ahold.

Costco

In Q3 2022, Costco posted a quarterly revenue of $54.437 billion. It’s a sharp decrease from the previous quarter, $72.091 billion. However, it has witnessed an 8.09 percent increase in terms of its year-over-year revenue.

Their e-commerce net sales witnessed a sharp incline since 2019. This might have been due to the COVID-19 pandemic, which led to more people purchasing their groceries online. It is predicted that the store will rake in close to $10 billion in ecommerce sales alone.

There are 112 warehouses owned by Costco that are used for online pickups. There is also planned expansion for 200 stores to offer pickups. The company is looking to leverage e-commerce, despite accounting for 8 to 9 percent of its total sales.

Aldi

The supermarket chain is considered to be one of the best budget options. In fact, one of the executives of the German-based Aldi stated that middle and high-income shoppers have become patrons of the store due to inflation in the United States.

As of 2022, the annual revenue is around $121.1 billion. In 2021, it had collected $529.1 million in online revenue alone. The 2022 numbers are expected to surpass the previous year’s (even though no final tally has been released).

Nevertheless, it is expected to be one of the most popular grocery chains for budget shoppers outside of Walmart.

Trader Joe’s

Trader Joes, whose parent company is ALDI Nord, is known for being unique compared to other grocery stores. It is the only major supermarket chain that does not offer delivery services. Thus, it risks losing shoppers and revenue in the process for this reason.

Nevertheless, its earnings are projected to be around $13.3 billion for 2022.

Final Thoughts

Many of the United States supermarket changes are seeing increases of revenue compared to past years. They are also witnessing a rise in online grocery and delivery sales as well. However, one of the major obstacles ahead is the increase in food prices.

It remains unseen as to what changes can be made. After all, those who use online pickup or delivery are subject to fees (where applicable). Adding that to an already increasing grocery bill can be a financial headache.

This may also reverse the trend of online grocery shopping (at least temporarily). But nevertheless, online grocery shopping is here to stay. Yet, there are still more people that still prefer grocery shopping the old-fashioned way.

The supermarket/grocery store industry’s evolution has been nothing short of breathtaking. And many of these chains have reaped the rewards of online shopping in the process. Especially when their future projections came sooner than expected.